Unpacking Less Common Issues in Divorce

A Lavelle Law Breakfast Briefs webinar

July 21, 2021

8:00 AM – 9:00 AM (CST)

Zoom

While even the most simple divorce proceeding can be complex, there are certain issues that make it more complicated, such as estate planning and immigration issues. On the other hand, amicable divorce proceedings can be resolved without extensive court proceedings by engaging in collaborative divorce. Join us for this Breakfast Briefs presentation as Lavelle Law’s family law attorneys, Amil Alkass, Joseph Olszowka, and Patti Levinson explore how these issues can impact a family law proceeding.

This webinar is FREE but registration is required. To register on Zoom, click the link below.

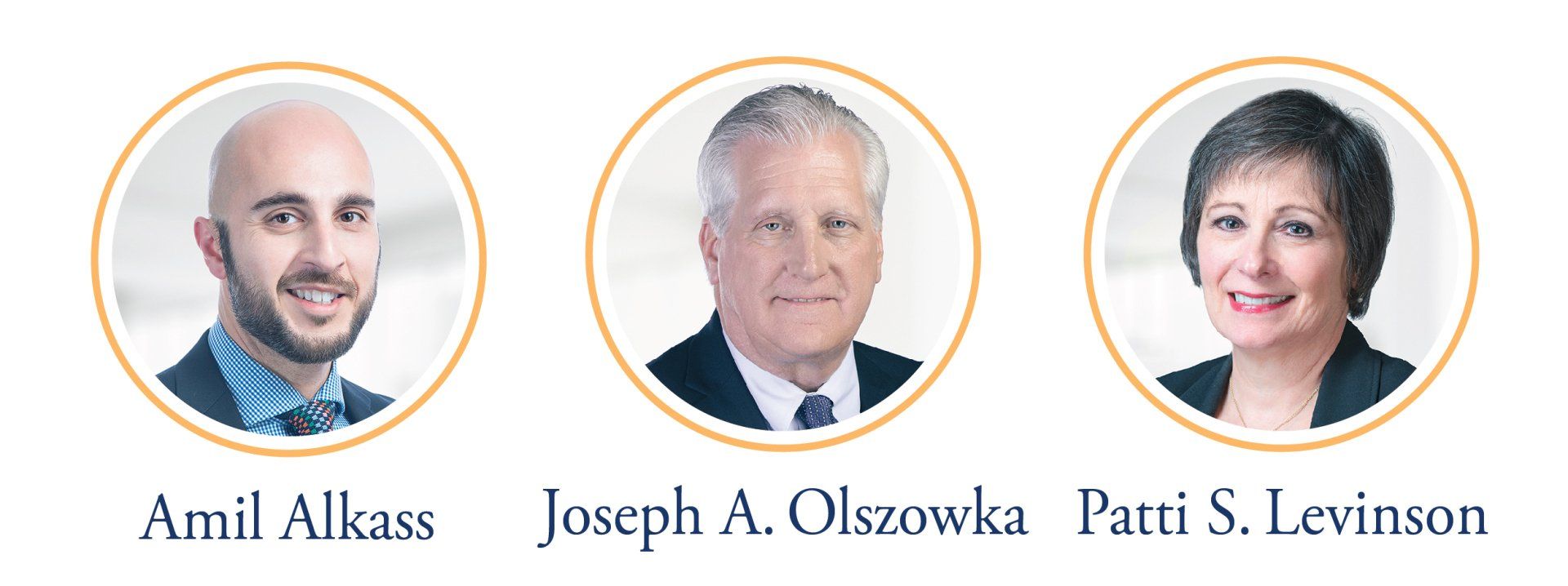

MEET THE PANEL

Amil Alkass

Amil Alkass is a Partner and has been an attorney at Lavelle Law, Ltd. since 2007. While Amil primarily focuses his work on matters related to divorce and family law, he also handles matters related to immigration law, commercial litigation, criminal and traffic defense, and automobile lemon law. Amil is a Board Member of the Assyrian-American Bar Association and a member of the Illinois Bar Association, the Chicago Bar Association, and the DuPage County Bar Association.

Amil received his J.D. from the UIC--The John Marshall Law School in Chicago and has a B.A. degree in Criminal Justice, with a minor in English, from the University of Illinois at Chicago.

Joseph A. Olszowka

Attorney Joseph Olszowka has nearly 30 years of experience handling family law cases. Before joining Lavelle Law’s Family and Divorce Law Practice Group, Mr. Olszowka was the Principal Attorney at the Law Offices of Joseph A. Olszowka, Jr., where he successfully litigated hundreds of cases, including complex divorce, parental allocation, parentage, child support, business valuation, adoption, and domestic violence cases.

Olszowka attended John Marshall Law School, has a certificate in family law, is on the DuPage and Will County approved Child Representative/Guardian ad Litem appointment list, and is an approved mediator in DuPage County and Will County for family law cases.

Patti S. Levinson

Partner and Family Law attorney, Patti Levinson, is an experienced attorney whose capability is strengthened by her training and accreditation in the Divorce Mediation Training Program at Northwestern University and the Collaborative Training Program from the Collaborative Family Law Council of Wisconsin. Ms. Levinson’s work has been recognized by the Collaborative Divorce Illinois and the International Academy of Collaborative Law Professionals.

Ms. Levinson is a regular participant in the Northwest Suburban Bar Association's Divorce Court and Paternity Court Facilitator programs, providing advice and assistance to parties without legal representation.

Levinson received her J.D. with High Honors from the Chicago-Kent College of Law, where she was accepted to the Order of the Coif.

More News & Resources

Lavelle Law News and Events

STAY UP TO DATE

Subscribe to our newsletter

Lavelle Law, Ltd. | All Rights Reserved |

Created by Olive + Ash.

Managed by Olive Street Design.