Tim’s Tax News on the Tenth – May 2022

The IRS’ Tax Gap Estimates Should be Coming Out Soon

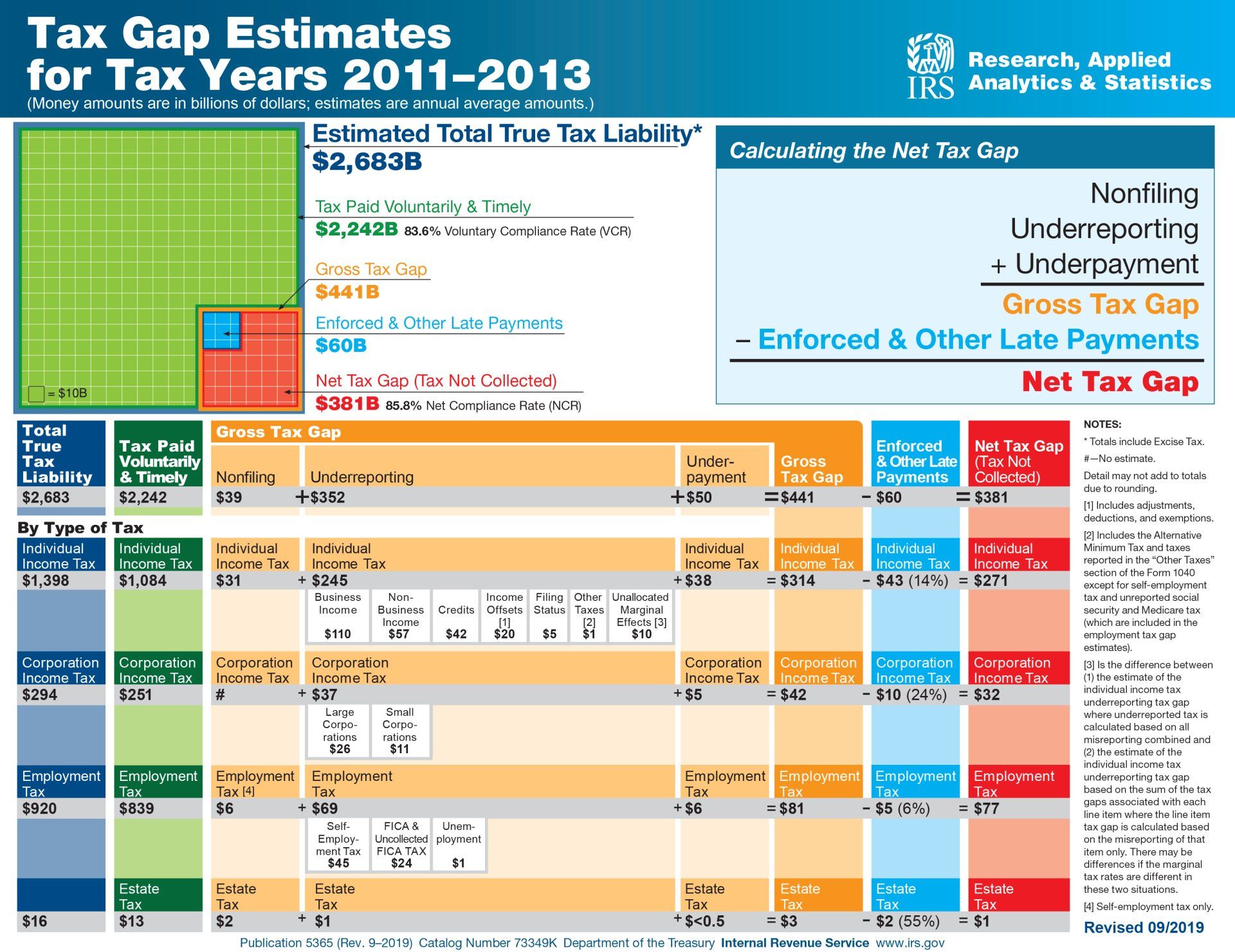

The Internal Revenue Service periodically estimates the tax gap to gauge historical overall compliance of all types of taxpayers with their federal tax obligations. The Gross Tax Gap is the difference between the amount of tax owed by taxpayers for a given year and the amount that is actually paid timely for that same year. It represents, in dollar terms, an estimate of the annual amount of non-compliance with our tax laws.

In general, the IRS’ tax gap estimates dating back decades consistently show the United States enjoys a relatively high and stable voluntary tax compliance rate. Sustaining and improving taxpayer compliance is important because small declines in compliance cost the nation billions of dollars in lost revenue and shift the tax burden away from those who do not pay their taxes onto those who pay their fair share on time every year. Understanding the elements of the tax gap enables policymakers and tax administrators to make better decisions regarding how to allocate resources used to administer the tax code. All initiatives by the IRS to improve tax collection are intended to narrow the tax gap and increase compliance.

The most recent IRS study of the tax gap was in 2019 and was an estimate for tax years 2011, 2012, and 2013. (See chart below.) That report showed the nation's tax compliance rate was substantially unchanged from prior years. The average gross tax gap was estimated at $441 billion per year based on data from those three years. After late payments and enforcement efforts were factored in, the net tax gap was estimated at $381 billion.

The IRS’ revised tax gap estimates translate to about an 83.6%, of taxes paid voluntarily and on time, which is in line with recent levels. That percentage is essentially unchanged from a revised Tax Year 2008-2010 estimate of 83.8%. After enforcement efforts are taken into account, the estimated share of taxes eventually paid is 85.8% for both periods. And that percentage is in line with the TY 2001 estimate of 83.7% and the TY 2006 estimate of 82.3%.

The voluntary compliance rate has been relatively stable from the pre Great Recession time period through the Great Recession and for the few years after. It will be interesting to see the impact of Covid-19 on later years’ studies.

If you would like more details, please do not hesitate to call our office. Our office has been successful in helping taxpayers with IRS and IDOR collection problems for over 29 years. If you have a tax or debt problem, please contact me at 847-705-9698 or thughes@lavellelaw.com and find out how we can help you.

Are you receiving the Lavelle Law eNewsletter? Sign up today and receive valuable updates and perspectives on a wide range of legal issues: http://bit.ly/3bu7KXj

Lavelle Law, Ltd. is registered with the Illinois Department of Financial and Professional Regulation as an approved continuing education provider for CPE for CPAs and Enrolled Agents. If your organization is seeking CPE courses in the area of Business Law, Innocent Spouse Relief, IRS Collections, Tax Scams (including ID Theft), or other areas in tax law that can be taught at your office, please contact me at thughes@lavellelaw.com

More News & Resources

Lavelle Law News and Events